Home / FOREX BROKERS / INDICATORS AND TOOLS FOR FOREX TRADING

Indicators and Tools for Forex Trading:

A Comprehensive Guide

Forex trading can be complex and challenging, but the right indicators and tools can make the process more manageable and increase your chances of success. These tools help traders analyze the market, make informed decisions, and execute trades effectively.

Whether you’re a beginner or an experienced trader, understanding how to use technical indicators, chart patterns, and other essential trading tools is crucial to your trading strategy.

In this article, we’ll dive into the most important Forex indicators and trading tools you can use to improve your trading performance, along with a detailed guide on their functions and applications.

What Are Forex Indicators and Tools?

Forex indicators are mathematical calculations based on the price, volume, or open interest of a currency pair.

Traders use these indicators to identify trends, market conditions, and potential entry or exit points.

Trading tools refer to platforms, software, and resources that help traders execute their strategies efficiently.

Some of the most common Forex indicators include moving averages, oscillators, and momentum indicators, while trading tools can range from charting software to economic calendars and automated trading systems.

Why Are Indicators and Tools Important in Forex Trading?

Indicators and tools serve a variety of purposes in Forex trading:

- Market Analysis: Indicators help traders analyze price action and identify trends, reversals, and key support/resistance levels.

- Timing and Decision Making: By understanding trends and patterns, traders can decide when to enter or exit the market.

- Risk Management: Tools like stop-loss orders and position sizing calculators help traders manage risk effectively.

- Automation: Many tools offer automation features, like Expert Advisors (EAs) on MetaTrader, to execute trades without manual intervention.

Top Forex Indicators Every Trader Should Know

1. Moving Averages (MA)

Moving averages are one of the most commonly used indicators in Forex trading. They smooth out price data over a specific period to identify trends and reduce market noise.

Types of Moving Averages:

- Simple Moving Average (SMA): The average price over a specified period.

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to market changes.

How They Are Used:

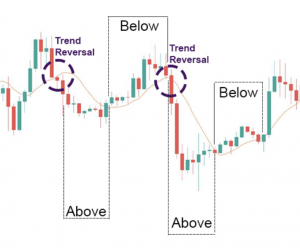

- Trend Identification: If the price is above the moving average, it indicates an uptrend; if below, it signals a downtrend.

- Crossovers: A common strategy is the Golden Cross (when a short-term moving average crosses above a long-term moving average) or the Death Cross (when a short-term moving average crosses below a long-term moving average).

Statistic: According to a 2023 survey by Trading Economics, over 70% of traders use moving averages to confirm trends and potential reversals.

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. RSI values range from 0 to 100 and are commonly used to identify overbought or oversold conditions in the market.

How It Works:

- Overbought: An RSI value above 70 typically indicates that the market is overbought and may experience a price correction.

- Oversold: An RSI below 30 suggests that the market is oversold and may be due for a rebound.

How It Is Used:

- Divergence: RSI divergence occurs when the price forms a new high/low while RSI does not. This can indicate a potential reversal.

- Trend Confirmation: Traders also use the RSI to confirm the strength of a trend. If RSI is above 50, the trend is considered bullish; if below 50, it’s bearish.

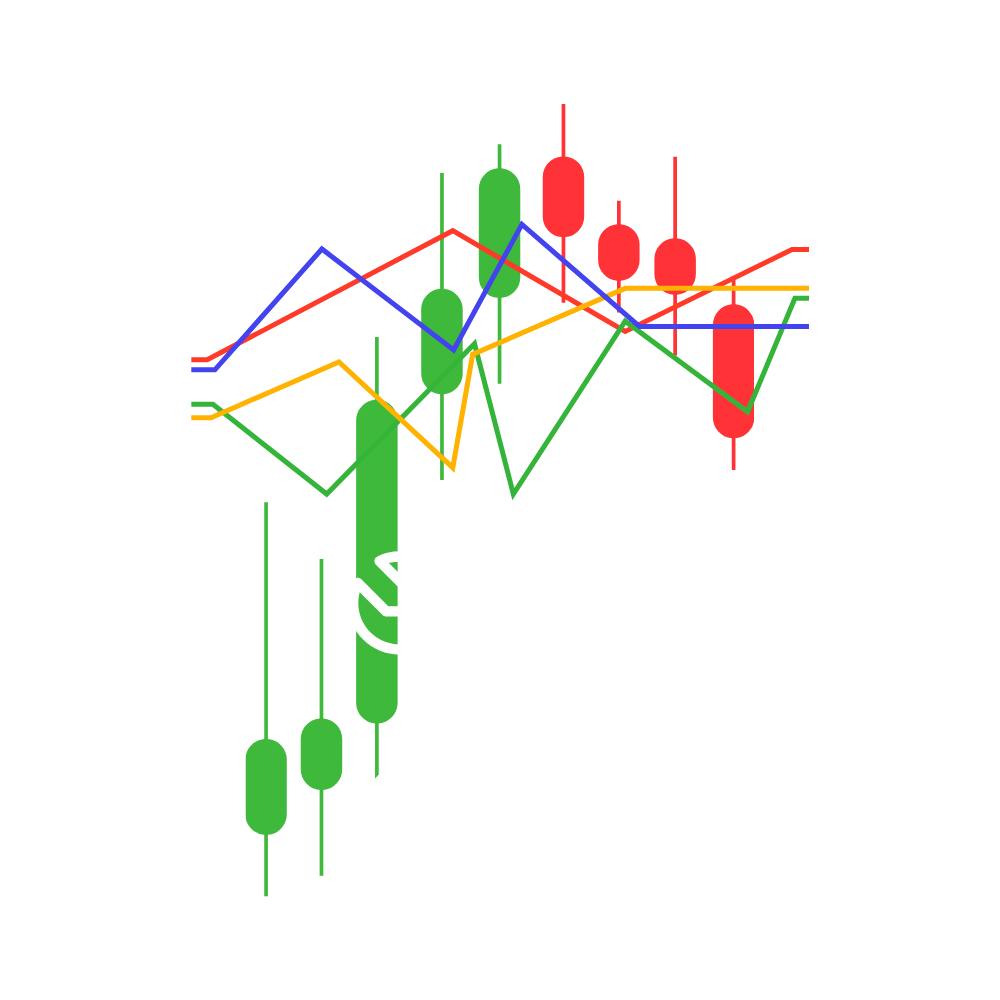

3. Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a currency’s price. It is used to identify changes in the strength, direction, momentum, and duration of a trend.

How It Works:

- MACD Line: The difference between the 12-day EMA and the 26-day EMA.

- Signal Line: A 9-day EMA of the MACD line.

- Histogram: The difference between the MACD line and the signal line.

How It Is Used:

- Crossovers: When the MACD line crosses above the signal line, it’s a bullish signal. When it crosses below, it’s a bearish signal.

- Divergence: Divergence between MACD and price action signals potential reversals.

4. Bollinger Bands

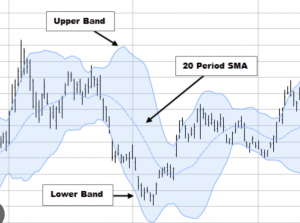

Bollinger Bands consist of three lines: a simple moving average (SMA) in the middle, with two standard deviation lines (bands) above and below the SMA. They are used to measure market volatility and potential overbought or oversold conditions.

How It Works:

- When the price moves close to the upper band, the market is considered overbought.

- When the price moves near the lower band, the market is considered oversold.

How It Is Used:

- Volatility Squeeze: A narrowing of the bands signals low volatility and potential for a breakout.

- Trend Reversals: A sharp move outside of the bands often precedes a reversal.

5. Fibonacci Retracement

Fibonacci Retracement is a tool used by traders to identify potential support and resistance levels. The key levels are derived from the Fibonacci sequence and are often used to predict the extent of a price pullback.

- How It Works:

- The most common Fibonacci levels are 23.6%, 38.2%, 50%, 61.8%, and 100%. These levels are drawn between the high and low points of a trend.

- How It Is Used:

- Entry and Exit Points: Traders use Fibonacci retracement levels to identify potential areas to enter or exit trades based on historical price movement.

Statistic: According to a study by Forex Factory, about 60% of professional traders use Fibonacci retracements to find key market levels and entry points.

Other Essential Forex Tools for Traders

While indicators are essential, other tools are equally important in enhancing your trading experience.

These tools can help with market analysis, risk management, and trade execution.

1. Economic Calendars

An economic calendar is an essential tool for traders who want to stay updated on key market events, such as interest rate decisions, GDP reports, and employment data. These events can cause significant volatility in the Forex market, making it crucial to know when they are scheduled.

- Top Economic Calendar Platforms:

- Forex Factory

- Investing.com

- DailyFX

2. Trading Platforms (MetaTrader 4/5)

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the most widely used trading platforms for Forex traders.

They offer advanced charting tools, automated trading with Expert Advisors (EAs), and seamless order execution.

- Features:

- Wide range of indicators and charting tools.

- Automated trading with EAs.

- Real-time data and news feeds.

- Customizable interfaces.

3. Risk Management Tools

Effective risk management is crucial for long-term trading success.

Tools such as stop-loss orders, position size calculators, and risk-to-reward ratio tools can help manage risk effectively.

- Position Size Calculator: Helps determine the right position size based on your account balance and risk tolerance.

- Stop-Loss Orders: Automatically close a trade at a predetermined price level to limit potential losses.

A global brokerage offering low-cost Forex trading and access to a wide variety of global markets for experienced traders.

A leading, highly regulated global broker offering competitive spreads and advanced trading platforms for all experience levels.

A popular social trading platform where users can copy successful traders and engage in a variety of asset classes.

A well-established broker known for low spreads, excellent customer support, and robust trading tools for all traders.

A versatile broker providing a wide range of account options, high leverage, and top-tier educational resources.

An Australian-based broker offering tight spreads and fast execution, ideal for scalpers and active traders.

A globally recognized broker known for low minimum deposits, high leverage, and a range of trading tools and resources.

A well-regulated Forex broker offering advanced tools, high-quality market analysis, and a wide range of account types.

A professional-grade broker with a wide range of markets, providing powerful platforms and in-depth research tools.

A user-friendly CFD trading platform that offers Forex trading with tight spreads and a simple, intuitive interface.

Choosing the Right Indicators and Tools for Your Trading Strategy

The key to successful Forex trading is finding a balance between different indicators and tools that suit your trading style and strategy. Here’s how to tailor your tools to your needs:

| Indicator/Tool | Best for | Key Benefits |

|---|---|---|

| Moving Averages | Trend-following traders | Identifies trend direction, smooths out noise |

| RSI | Momentum traders | Identifies overbought/oversold conditions |

| MACD | Trend reversal traders | Provides entry/exit signals, momentum confirmation |

| Bollinger Bands | Volatility-based traders | Identifies breakouts, potential reversals |

| Fibonacci Retracement | Swing traders, trend-following traders | Identifies support/resistance levels |

| Economic Calendar | Fundamental traders | Stay updated on key economic events |

| MetaTrader (MT4/MT5) | All traders | Full-featured trading platform with automation |

Conclusion

Using the right indicators and tools in Forex trading can greatly improve your ability to analyze the market, manage risk, and make informed trading decisions.

Whether you’re using moving averages, RSI, MACD, or more advanced tools like Fibonacci retracement and economic calendars, each tool has a specific purpose that can complement your overall trading strategy.

By combining different indicators and tools and adapting them to your personal trading style, you can increase your chances of success and make more confident trading decisions. The key is practice and continuous learning to refine your skills and make better use of the available tools.

Author,

leading expert at FBX

Robert has been working in financial market valuation and analysis since 2008.

Years of experience and deep immersion in the topic give us every reason to trust his expertise.